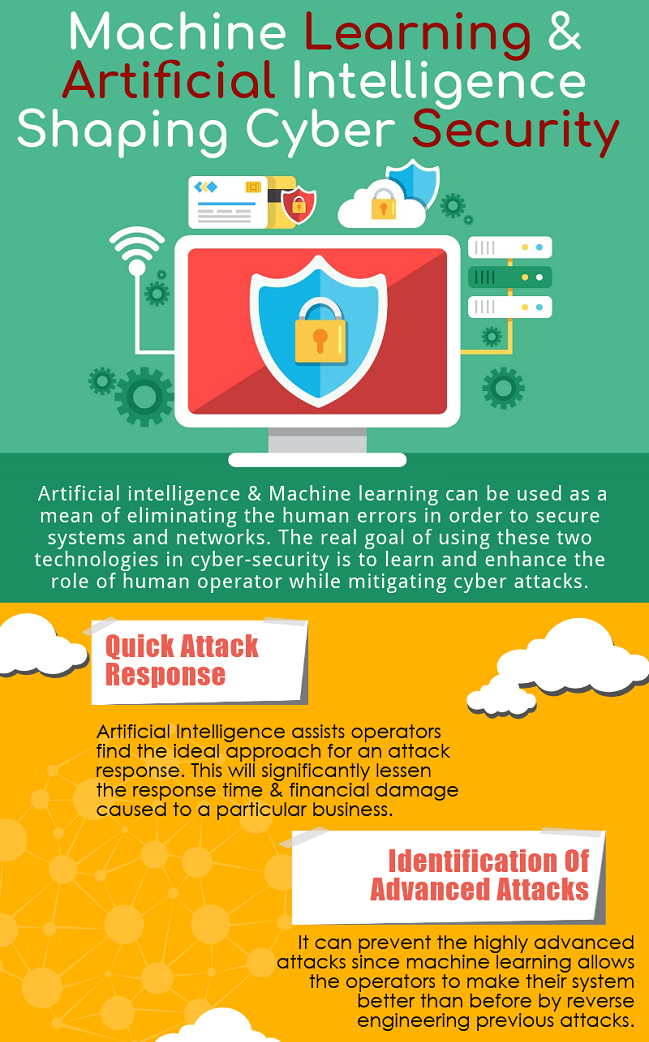

Artificial Intelligence (AI) and Cognitive Computing (CC) have opened a new era of cybersecurity.The following are a few examples of how AI can be used to improve and enhance cybersecurity: –

- Defending against ransomware – With the introduction of RaaS (Ransomware as a Service), criminals no longer need technical competence to launch an attack. AI-based cybersecurity technologies can regulate attack surfaces and identify/mitigate supported forms of cyber attacks in a large company.

- Optimizing cybersecurity in S-SDLC with AI enhancement – If your organization develops software, whether it’s desktop software, mobile apps, online apps, or programs that run on IoT (Internet of Things) devices, you should include cybersecurity in your development process. Occasionally, the development agency lacks the resources to do extensive security testing. This is where AI-powered testing services come in useful. These code testing solutions can perform in-depth code analysis as well as advanced penetration testing.

- DGA-Generated domains detection using deep learning algorithms – Domain Generation Algorithms (DGAs) are computer programs that produce pseudo-random domain names (for example – sdlkfusdlfl.com). Malware that calls home (attempts to connect to an external network for command and control) uses pseudo-randomly generated domain names to remain anonymous. DGA algorithms can produce hundreds of thousands of domain names. Trying to ban them all is a pointless exercise because one will get through and connect eventually. In this scenario, AI-based deep learning is being utilized to detect rogue domains generated by a DGA. After viewing enough of these pseudo-random domains, the system is trained to detect them.

- Detection, prevention, and remediation of non-malware threats – CryptXXX, CTBLocker, and PowerWare. Web browsers, Microsoft Office applications, and operating system utilities such as PowerShell and Windows Management Instrumentation are frequently used in non-malware attacks. The majority of non-malware threats are recognized by observing computer activity after the incident. Working with a cybersecurity analyst to educate AI-based solutions as well as using neural networks and machine learning algorithms to observe typical behavior, will aid in the creation of improved detection methods.

- Stealth, adaptive, and evolutionary Honeypots and Honeytokens – Hackers are attracted to honeypots and honeytokens. Computers, passwords, and other fictitious information are set up on a network to start the process of gathering information about the attack and, eventually, the attacker. The advanced versions of adaptive honeypots and honeytokensare empowered with AI based systems that adapts its behavior in response to the assault, tempting the attacker into revealing as much information as possible. The adaptive honeypot responds by initiating protection in the same way as a protected computer would. When confronted with a new problem, the analyst can learn a lot about the attacker’s skill level and tools by seeing how they respond. As a result, an AI solution can learn and recognize the behavior in the future.

Machine learning and AI can definitely be used to keep updated with the attackers’ tactics in today’s constantly evolving cyber-attacks and proliferation era. Automating threat detection and response are now more effective with use of AI based cybersecurity tools.

Centex Technologies provide enterprise cybersecurity and network security solutions. To know more, contact Centex Technologies at Killeen (254) 213-4740, Dallas (972) 375-9654, Atlanta (404) 994-5074, and Austin (512) 956-5454.